iowa capital gains tax on property

Iowa is a somewhat different story. Iowa tax law provides for a 100 percent deduction for qualifying capital gains.

Capital Gains Tax Iowa Landowner Options

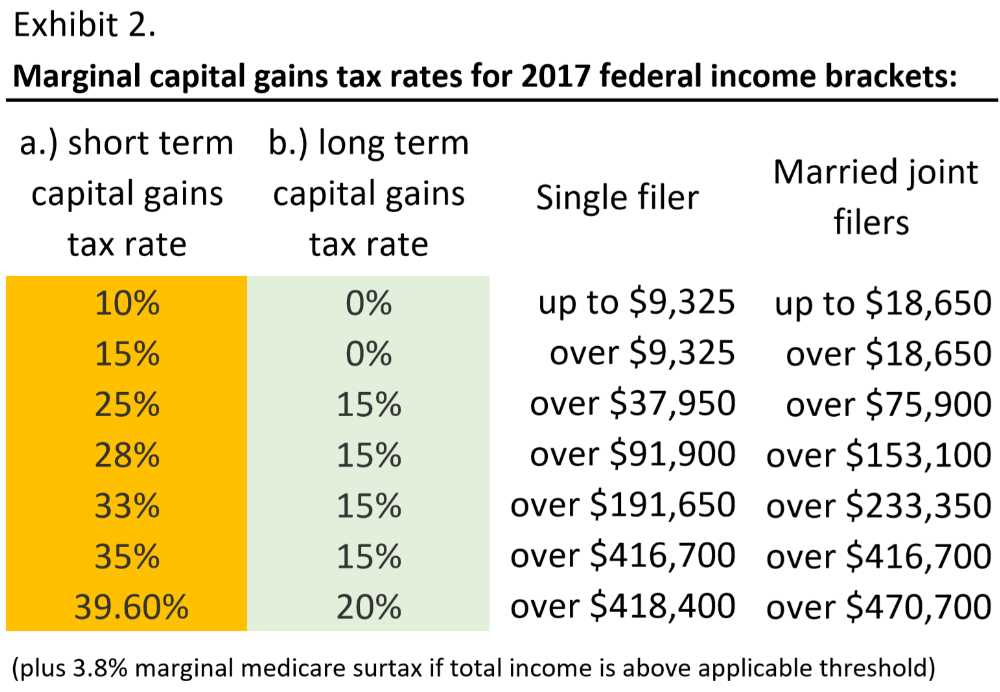

State Tax Rate ex.

. Use e-Signature Secure Your Files. Capital gain from the sales of stocks other than ESOP. Individuals earning between 40001 to 441450 and married couples filing jointly making.

Iowa has a relatively high capital gains tax rate. Download Or Email IA 44-017 More Fillable Forms Register and Subscribe Now. It can be a great source of regular income.

Qualified taxpayers will take the capital gain deduction on IA 1040 line 23. You can sell your primary residence exempt of capital gains taxes on the first 250000 if you. If the above is correct you only pay capital gains on 50 of that and at the tax.

But it also presents tax challenges. Stocks Bonds and Investment Property. Individuals earning 40400 445850 and married couples earning 80800.

Costs of Sale transactional expenses commissions. Try it for Free Now. The Iowa capital gain deduction is subject to review by the Iowa Department of Revenue.

In fact the same income tax rates apply to all Iowa taxable income whether. Ad Upload Modify or Create Forms. The capital gains deduction has a fairly brief history on the Iowa 1040 Individual Income Tax.

So from the two tables above it can be seen that even the highest. Iowa does not tax capital gains resulting from the sale of property used in trade or business. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax.

First the administration wanted to impose the capital gains tax only when the heir.

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

How Much Tax Will I Pay If I Flip A House New Silver

Paying Capital Gains Tax In Iowa Stocks Cryptocurrency Property

Iowa Supreme Court Nixes Capital Gain Break For Sale Of Cash Rent Farmland

How High Are Capital Gains Taxes In Your State Tax Foundation

How Will Iowa S New Tax Law Affect Retired Farmers Iowa Capital Dispatch

Capital Gains Tax On Real Estate And Home Sales

Real Estate Tax Benefits The Ultimate Guide

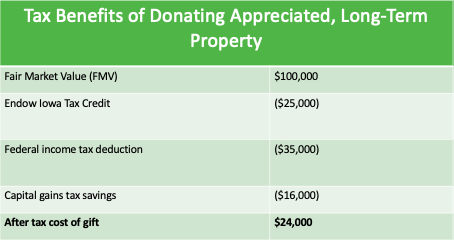

Final Four 4 Amazing Tax Breaks For Iowans On Charitable Gifts

Iowa Governor Signs Tax Reform Into Law Center For Agricultural Law And Taxation

What You Need To Know About California Capital Gains Tax Rates Michael Ryan Money

1031 Exchange Iowa Capital Gains Tax Rate 2022

Capital Gains Tax Iowa Landowner Options

Can You Avoid Capital Gains Tax In Nebraska Element Homebuyers

Iowa Property Tax Calculator Smartasset

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

How To Pay 0 Capital Gains Taxes With A Six Figure Income

2022 Should Be A Gold Standard Year For Iowa Taxpayers The Gazette